Why Choose Globe Life High Deductible Plan G?

If you are currently enrolled in a Supplement Plan in New York, you might have noticed with all the healthcare changes, the annual premiums increase continuing to rise every year.

We are proud to offer a Medicare supplemental plan in New York that will save you money each year while still maintaining the great Medicare coverage you rely on.

If you rely on Medicare benefits in New York, rising premiums on traditional Medicare Supplement Plans like Plan F, Plan G, or Plan N can feel overwhelming. At PlanMedicare, we specialize in helping clients switch to smarter options, like Globe Life’s High Deductible Plan G (HDG) without sacrificing coverage.

Why New Yorkers Choose Globe Life High Deductible Plan G?

The High Deductible G+ Plan, is a great medigap policy for anyone currently enrolled in a supplement plan. The G+ Plan has the same exact coverage as any Supplement Plan (same doctors, same coverage, same flexibility) but instead of a high monthly premium, like most of current Supplements, it has a very low monthly premium and a high deductible instead.

- Same Coverage, Lower Cost: This Medicare Supplement Insurance plan offers identical benefits to standard Plan G, including coverage for Medicare Part A inpatient hospital stays and Medicare Part B coinsurance, but with a dramatically lower monthly premium.

- Affordable Premiums: Instead of paying $350–$400 per month for Plan G, Globe Life’s HDG costs about $91 per month.

- Manageable Deductible: You pay out-of-pocket costs up to the deductible amount ($2,950 per calendar year)—after that, all covered medical expenses are paid at 100%.

- Freedom & Flexibility: No networks, no restrictive insurance company rules—works anywhere Original Medicare is accepted.

Depending on the plan type, switching to the G+ plan can save you more than $5,000 per year.

Cost Comparison

| Plan Name | Monthly Premiums | Annual Premiums | Max Annual Exposure |

|---|---|---|---|

| Plan F | $419 | $5,028 | $5,028 |

| Plan N | $299 | $3,588 | No Cap+++ |

| Plan K | $113.75 | $1,365 | $8,000 |

| Plan G | $372.50 | $4,470 | $4,753 |

| G+ Globe Life | $91 | $1,092 | $4,042 |

Even if you hit the deductible, your maximum annual exposure is still lower than most Medigap plans

Coverage Comparison

The high-deductible G plan has the exact same coverage as any other Supplement plan from any other carrier. This is because Medicare remains the primary insurance.

- Works anywhere Medicare is accepted

- Medicare remains primary

- No networks, full freedom nationwide

- Full flexibility to switch to a different Supplement at any time in NY without any delay

How The High Deductible Plan G Works

The main difference between the High Deductible G+ plan and other Medicare Supplement plans is how you pay for your coverage. The G+ plan offers much lower monthly premiums in exchange for a higher annual deductible of $2,950.

With the G+ deductible, Medicare always pays 80% of the Medicare-approved amount for covered services such as doctor visits, labs, and imaging, and you are responsible for the remaining 20% until your out-of-pocket costs reach the $2,950 deductible. Once you meet that deductible, all covered expenses are paid at 100% for the rest of the year.

If you do reach the deductible, your maximum annual exposure is still lower than with other supplement plans. And if you don’t hit the deductible, you save even more thanks to the significantly lower premiums.

About Globe Life

Globe Life Insurance Company is one of the most trusted names in the health insurance and Medicare Supplement Insurance market. With decades of experience, Globe Life provides affordable and reliable coverage options for Medicare beneficiaries, including the popular High Deductible Plan G (HDG) and High Deductible Plan F (HDF). These plans are designed to help clients reduce monthly premiums while maintaining comprehensive Medicare benefits.

As part of its commitment to serving seniors nationwide, Globe Life partners with United American, a leading insurance company specializing in Medigap plans. Together, they offer flexible insurance policies that work seamlessly with Original Medicare, covering everything from inpatient hospital stays under Medicare Part A to outpatient services and Part B coinsurance.

With Globe Life and United American, you get:

- Affordable coverage with lower premiums and manageable out-of-pocket costs

- Nationwide acceptance—works anywhere Medicare-approved providers are available

- Plans that include benefits like foreign travel emergency protection and no restrictive networks

When you choose Globe Life, you’re choosing a company that understands the needs of Medicare beneficiaries and delivers solutions that make sense for your budget and lifestyle.

Key Benefits of High Deductible Plan G

- Covers inpatient and outpatient services under Medicare-approved guidelines.

- Includes foreign travel emergency coverage.

- No hidden copays, no surprise part B excess charges.

- Full flexibility to switch back if needed.

Stop overpaying for health insurance.

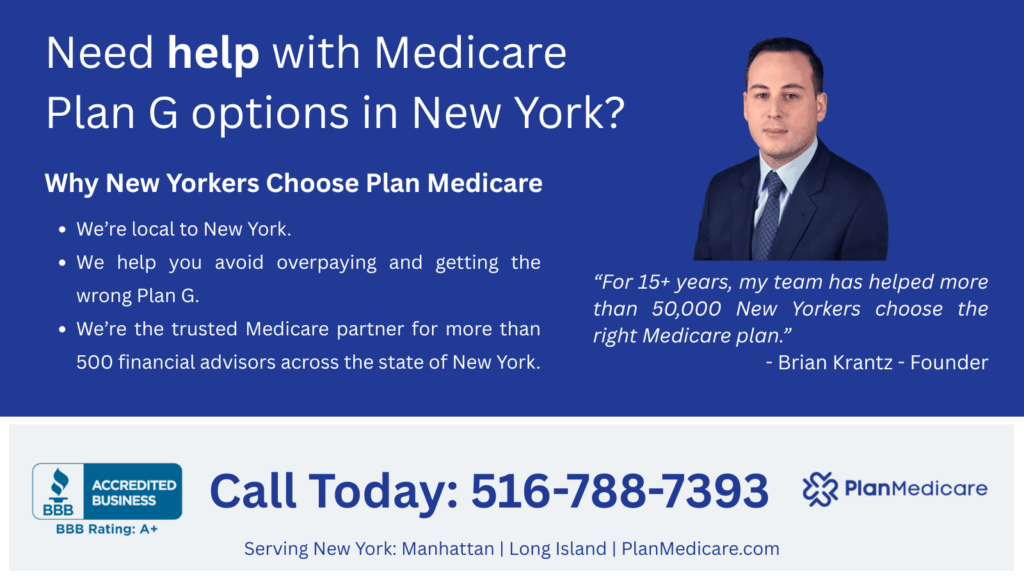

Why PlanMedicare?

We are the health insurance agency of choice for Medicare Supplement Insurance in New York with over 15 years of service and 30,000 New Yorkers enrolled. Our licensed insurance agents guide you through open enrollment, switching from Plan F, Plan G, or even High Deductible Plan F (HDF) to Globe Life’s HDG with guaranteed issue—no underwriting, no delays.

Let PlanMedicare help you secure the best insurance policy for your needs. Call 516-900-7877 or book your appointment today.

Enroll in Globe Life High Deductible Plan G

Switching your Supplement Plan in New York is simple, because there is no medical underwriting.

You can move your current Supplement plan to the G+ at any time and move back to your old carrier if for whatever reason you are not satisfied.

Switching to the high deductible G is an obvious way to save money, while maintaining the same exact coverage as you currently have.