High Deductible Plan G Benefits and Costs for 2026 in New York State

If you are exploring Medicare Supplement Plans to help cover costs not included in Original Medicare, you may already know about Plan G. But there is another option that could save you money, the High Deductible Plan G.

This plan offers the same benefits as standard Plan G but with a higher deductible and lower monthly premium.

Let’s discuss the following:

- How it works, and what it covers.

- What it costs based on where you live in New York

- Is it even the right for you?

- How to get enrolled.

What Is High Deductible Plan G?

High Deductible Plan G, sometimes called Plan G Plus, is a Medicare Supplement Insurance Plan that works alongside Original Medicare Part A and Part B. It covers most Medicare-approved costs such as coinsurance, copayments, and excess charges after you meet the annual deductible.

- 2025 Annual Deductible: $2,870

- Includes the Medicare Part B deductible ($283 in 2026)

- After meeting the deductible, the plan pays 100 percent of covered services

How Does High Deductible Plan G Work?

- Enrollment

You must have Medicare Part A and Part B and meet eligibility requirements. You can purchase this plan from any insurance company that offers Medicare Supplement Insurance Plans in your state. For those that live in New York, Globe Life is an excellent priced high deductible plan g. Read more about globe life plan g. - Pay Out of Pocket Costs Until Deductible

During the calendar year, you pay coinsurance, copayments, and Part B excess charges (not if you live in NY) until you reach $2,870. This includes inpatient and outpatient costs under Medicare Part A and Part B. - Full Coverage After Deductible

Once the deductible is met, the plan covers:- Part A coinsurance and hospital costs

- Part B coinsurance and copayments

- Part A deductible

- Skilled nursing facility care coinsurance

- Part B excess charges

- Foreign travel emergency care (up to plan limits)

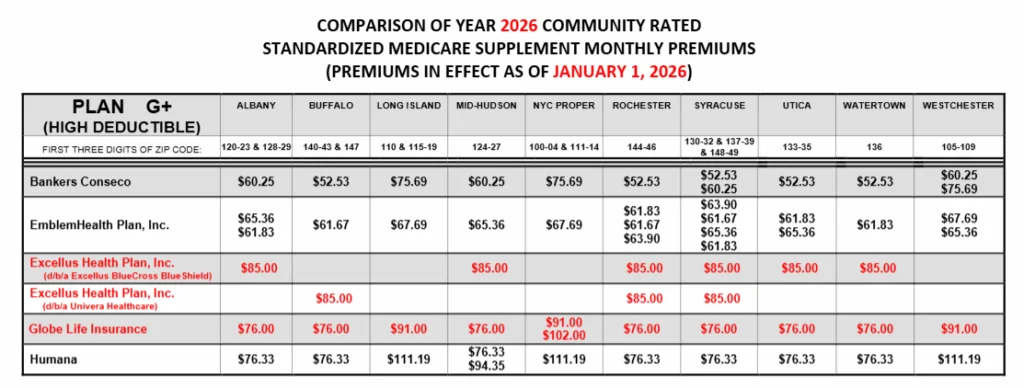

High Deductible Plan G Costs in 2026 for New York

- Monthly Premium: Often $52 to $102 (varies by state and insurer)

- Annual Deductible: $2,870

- Out of Pocket Maximum: $2,870 (after which all Medicare-covered costs are paid)

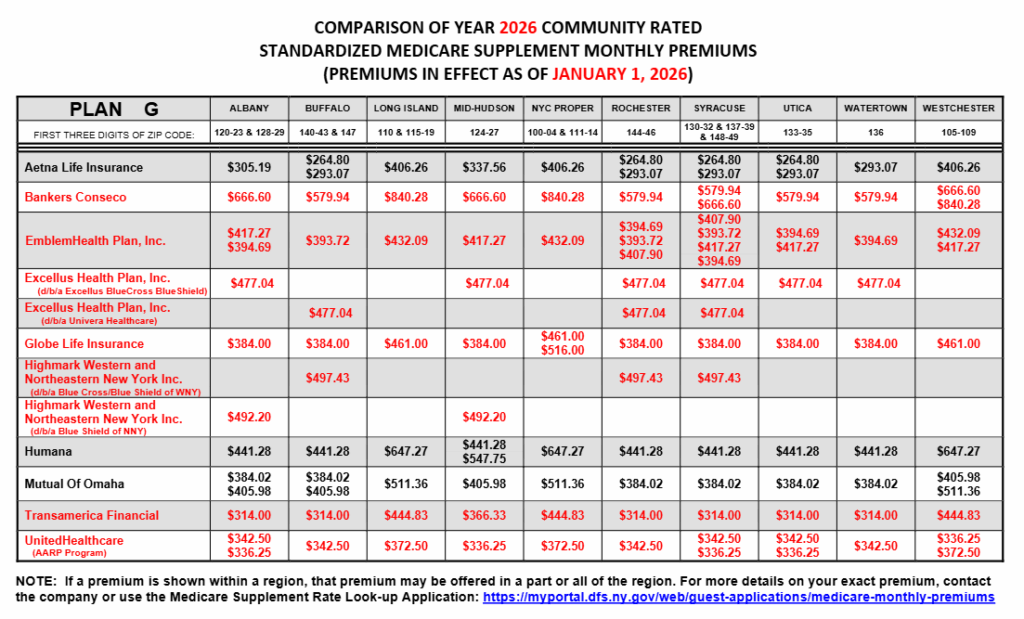

We looked the costs for both types of Plan G plans in New York and provided the breakdown by both zip code and area which includes Albany, Buffalo, Long Island, Mid-Hudson, NYC Proper, Rochester, Syracuse, Utica, Watertown and Westchester. Look at your respective location and you can see what the high deductible plan will cost you for each insurance company that offers these plans in the state of New York. PlanMedicare is licensed to help with your Medicare supplement plan enrollments in all cities in New York as well as 50 states.

Compare High Deductible Plan G Costs

Compare Plan G Costs

If you look compared to standard Plan G, which has higher monthly premiums (often $150 to $200 or more) and only the Part B deductible, you can clearly see why some people on Medicare might be better off using the high deductible Plan G that offers lower premiums with higher upfront risk. This is not a right or wrong answer, it’s going to be a perfect fit for some people and not for others. It’s our job to work together to help you make the right decision.

Plan G and HDF Pros and Cons

Advantages

- Lower monthly premium saves $600 to $1,800 annually

- Same benefits as standard Plan G after deductible

- Freedom to choose any Medicare-approved provider nationwide

- Guaranteed renewability

Disadvantages

- Higher out of pocket expenses early in the year

- Not ideal for frequent doctor visits or those with chronic conditions

- Does not cover dental, vision, prescription drug coverage, or durable medical equipment beyond Medicare limits

Who Should Consider High Deductible Plan G?

This plan is best for those who:

- Tired of paying more for their current Plan G and want to explore an alternative

- Are generally healthy with few health care costs

- Want lower premiums and can manage the annual deductible

- Prefer flexibility over restrictive Medicare Advantage Plans

If you expect frequent inpatient or outpatient care, consider Plan G, Plan N, or Plan F for predictable costs.

FAQs for 2026

What does High Deductible Plan G cover?

All Medicare benefits covered by standard Plan G, including coinsurance, copayments, Part B excess charges, and foreign travel emergency care, after meeting the $2,870 deductible.

What is not covered?

Routine dental, vision, hearing, drug plans, and Medicare Part D. These require separate insurance plans.

What is the out of pocket maximum?

$2,870 in 2025, plus your monthly premium.

Does it include the Part B deductible?

Yes, the Medicare Part B deductible ($283) counts toward the $2,870 annual deductible.

Summary & Next Steps

High Deductible Plan G offers lower premiums and full coverage after the deductible, making it a smart choice for healthy individuals who want to minimize monthly premium costs.

But if you anticipate high healthcare usage, a standard plan may be better.

Ready to compare Medicare Supplement Plans? We have office conveniently located in New York City at 5th and 58th as well as Long Island in Melville.

Call us today at 516-900-7877 or Book an Appointment with a licensed insurance agent today.